Grandparents are usually willing to help with college expenses when possible. I remember my own grandmother chipping in a bit for my freshman year at school. Knowing what I know now, it’s likely that the gift had a negative impact on my financial aid eligibility.

The rules surrounding need-based financial aid can be confusing and overwhelming to most. Let’s explore some ways that grandparents can help pay for college without negatively impacting their grandchildren’s eligibility for need-based financial aid.

529 Accounts

529 accounts are one of my favorite college savings vehicles. The combination of tax benefits and flexibility make them very appealing. However, who owns the account and when distributions are taken are very important factors for aid purposes.

Ownership – Some grandparents will contribute to a 529 account in a parent’s or grandchild’s name. Because 529 accounts count as parental assets under the guidelines of the Free Application for Federal Student Aid (FAFSA), those monies will reduce the amount of aid the student is eligible for. It’s usually best for a grandparent to establish the 529 plan in his or her own name so it won’t impact need-based aid eligibility on the FAFSA.

Distributions – Special care should also be taken when 529 distributions are made. Grandparent-owned 529 distributions are considered “untaxed income” and can reduce a student’s aid award. The best solution for grandchildren who won’t attend graduate school would be to make the distributions when they are in their junior or senior year of college. This is due to the new “Prior-Prior” rules that use the student’s sophomore year as the final “base” year for assessing need-based aid eligibility.

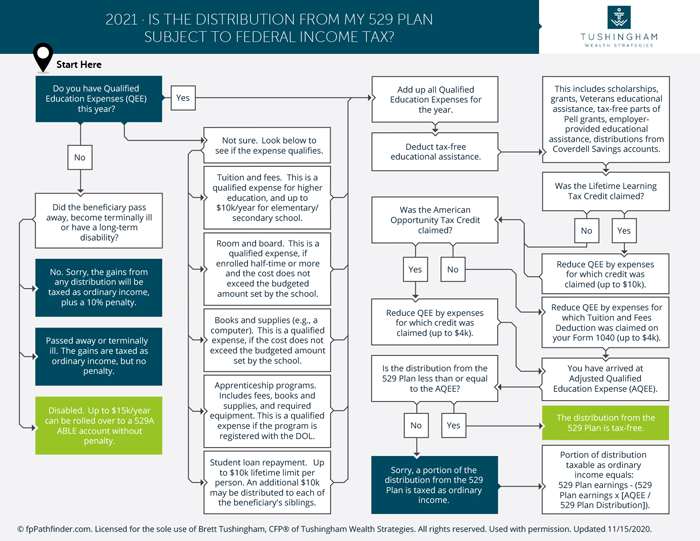

Is the distribution from my 529 plan taxable in 2019?

Download this flowchart to help find the answer.

Gifts

When it comes to financial aid, grandparents need to be careful when making gifts directly to the grandchild or school.

Cash – Cash gifts made to children will count as “untaxed income” and assessed at up to 50% for financial aid purposes. Worse yet, cash payments made by grandparents directly to the school will reduce need-based aid dollar for dollar! This strategy should only be utilized if the family will not qualify for need-based aid.

Securities – Gifting appreciated securities to a grandchild can be an appealing strategy. When done properly grandparents can help pay for college and avoid paying any capital gains tax. This strategy works best when the family is certain that they will not qualify for need-based aid and the grandchild can avoid the kiddie-tax.

Following the “Prior-Prior” rules, the best time to make gifts, cash or securities, is in the grandchildren’s junior or senior year of college. As long as graduate school is not planned, gifts received in the last two years of college will be excluded from the aid calculations.

If the student needs money for freshman- or sophomore-year expenses, then the best option would be to make a gift to the parents, which would count less in financial aid calculations.

One of the first steps in the college planning process should be to determine if your child qualifies for need-based aid at the schools of his or her choice. If the answer is no, then it doesn’t matter who owns the assets, receives the income or when the gifts are made for aid purposes.

At that point your focus should shift toward merit aid, tax aid and how to best use your personal resources to pay your share of the cost.

Download our Free Whitepaper on

Understanding College Financial Aid: Download Now