Optimizing your employee benefits is pivotal to your retirement planning. With so many options nowadays, it can be confusing to determine what benefits to select. This can get even more complicated when both spouses have access to benefits.

So, what can you do to make this a painless process? The key is to be informed of your options, five, to be precise.

Health insurance

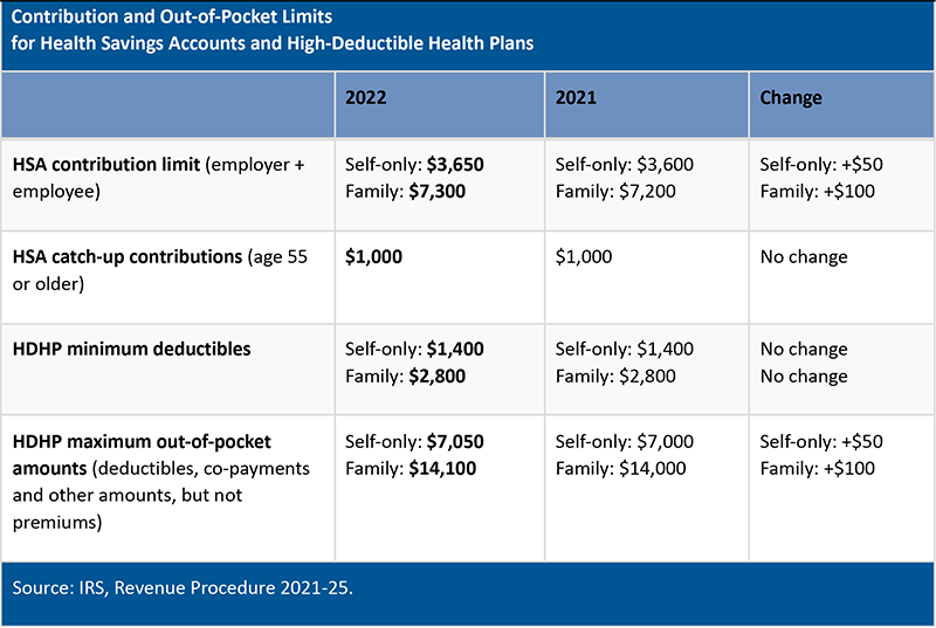

The foundation of your benefits plan will be health insurance. You will most likely choose between a low deductible plan such as a Preferred Provider Plan (PPO) or a high-deductible health plan (HDHP). The HDHP plans are accompanied by a health savings account (HSA) which allows you to set aside money on a pre-tax basis to pay for most medical expenses tax-free.

If you foresee minimal health care expenses and can afford to pay the higher deductible, then you should consider the HDHP plan. Yes, the deductible is higher, but the premiums are substantially less and most employers will make contributions towards your HSA plan. The balances in an HSA can also be carried forward if not used.

If your spouse also has a plan you will want to compare the costs to add the family onto your plan vs. taking separate policies.

Disability

The primary goal of any insurance is to protect you against a potentially catastrophic event. One of those events would be a loss of income if you weren’t able to perform your job.

Imagine making $200,000 a year and being unable to do your job five years. That’s $1,000,000 in lost income. This is more than most family’s homes and an event that is much more likely to happen than you think.

You want to apply for the maximum available disability. And since most disability is company paid the benefit will be taxable. This could result in a shortfall of coverage. For example, if the company will pay a 60% benefit that is taxable, and you’re in the 30% tax bracket(federal and state), that will leave you with an after-tax benefit of 42%. This is in contrast to an after-tax benefit of 70% if you were fully employed.

If you have a shortfall in coverage, we recommend that you look into private disability coverage to supplement your employer coverage.

Life insurance

You are much less likely to die prematurely than to suffer a disability. This doesn’t mean that life insurance should be overlooked. If people rely on you for income, and you don’t have a sufficient asset base to replace that income, then you need coverage.

There is no need to purchase fancy insurance policies with cash value and investments. Keep it simple and look to term insurance to meet your needs. Take the free coverage that is company-provided. This usually is at least $50,000. Contact a Certified Financial Planner, CFP® if you need assistance determining the proper amount and duration of coverage.

Most life insurance provided by your employer will be group term. This means the policy is issued to cover a group of people and is usually contingent on employment. If you are in good health it usually pays to buy private term coverage to supplement additional insurance needs. The cost will most likely be less, the policy is portable, and premiums are stable. If you can’t qualify for private coverage you will want to pivot back to your employer to see if you can obtain additional coverage without underwriting.

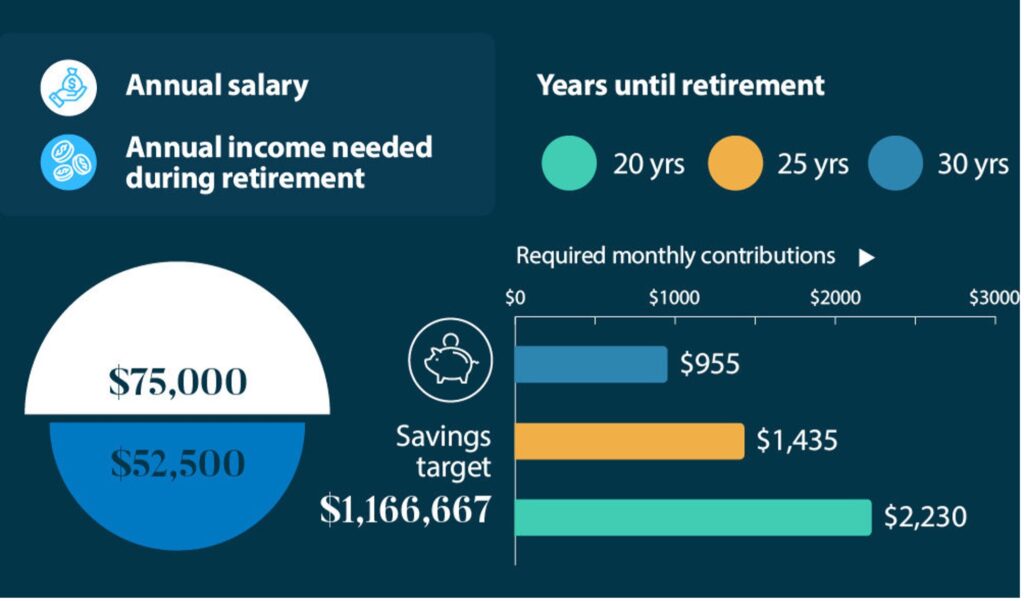

Retirement

Most everyone is familiar with a 401(k) or 403(b) account. You will have the option to contribute up to $20,500 in 2022 pre-tax, or possibly after-tax if a Roth option is offered. If you turn 50 this year you will be eligible to contribute an additional $6,500. The priority is to contribute at least up to the company match and start saving as soon as possible.

The decision to choose the Roth option will depend on your tax situation. If you foresee your tax bracket increasing in the future you will want to consider it as qualified distributions will be tax-free.

Some executives and physicians will also be offered supplemental plans such as a 457(b). These plans allow you to put an additional $20,500 away towards retirement if cash flow allows.

Flexible Spending Accounts

These accounts let you set aside money pre-tax, including Social Security and Medicare taxes, and use funds tax-free for qualified dependent care and health care expenses. You will need to estimate your annual expenses as it is a “use it or lose it account”, although some companies will give extensions on this provision. Benefits enrollment takes place in October or November for most companies. Most elections are irrevocable which means you only get one chance a year to make the right choice. Take the time to review your options and reach out to us if you have any questions.