We get this question a lot, especially around year-end. As most people already know, capital gains are taxed at lower rates than ordinary income. But at what rates are they taxed at and what is the primary driver in determining those rates?

I wish I could say that the tax code is easy to interpret and the same for everybody, but that is not the case. Let’s take a short dive into the types of capital gains and how the rates are determined.

Short-Term vs Long-Term

Short-term capital gains, or assets sold for a gain with a holding period of a year or less, would be taxed at your ordinary tax rates. Assets with a gain and sold after a one-year holding period would be considered long-term capital gains and usually taxed at lower rates.

Ordinary Income vs. Capital Gains

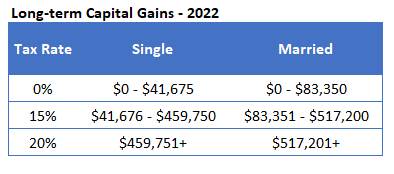

Your long-term capital gains rate can range from 0% to 20% and is based on your taxable income. Your taxable income is your ordinary income plus capital gains less deductions.

The tax code taxes your ordinary income first, then adds long-term capital gains on top, and then uses deductions to reduce your ordinary income first and capital gains second. This works to your advantage as ordinary tax rates are generally higher than long-term capital gains rates.

Let’s take an example. A married couple with a taxable income of $75,800 would be able to realize an additional $5,000 of capital gains and pay nothing in federal tax. However, if they then executed a Roth conversion for $5,000 that would push their capital gains rate from 0% to 15%.

The primary point is that additional ordinary income can push you into a higher capital gains rate.

Planning Opportunities

Understanding the relationship between capital gains and ordinary income taxes – and the order in which they’re taxed – can open up several planning opportunities.

You should perform an annual tax review to help determine if there are opportunities to pay lower taxes than you normally would.

Those opportunities might be the result of the following:

- Temporarily unemployed or receiving a lower salary

- Selling real estate for a loss

- You haven’t started Social Security benefits or required minimum distributions from your retirement accounts

You can further reduce your taxable income by optimizing company plans such as health savings and retirement accounts and grouping your charitable contributions.

If you do find yourself in any of these scenarios you might want to consider doing a Roth Conversion or realizing long-term capital gains, or a combination of both. The additional income might impact your premium tax credits, taxation of Medicare premiums, need-based financial aid and other deductions so proactive planning is a must.

FLOWCHART: Should I Do a Roth Conversion?

Perhaps you still have questions on whether a Roth conversion makes sense and what’s the optimal amount to convert. Maybe you have questions on how to reduce your capital gains tax. Our “Personal CFO” service can help answer your questions. Please schedule a call below to explore if we’re a good fit.