Physicians face many unique challenges when it comes to financial planning. Most graduate school with student loans, they have substantial liability exposure and begin saving for their retirement at a late age.

Proactive planning can help you address these challenges and keep you on a secure path towards retirement.

Student Loans – The cost of education is increasing and so has student loan balances for most physicians. It is not uncommon for a physician to graduate with over $200,000 in loans.

Most will want to refinance their Federal student loans early to reduce their borrowing costs. But this isn’t always the wisest decision. Public Service Loan Forgiveness (PSLF) might be the best path for physicians planning to work for a not for profit.

You lose the ability to use PSLF when you refinance your federal loans with a private lender. Before refinancing talk to someone well versed in the PSLF process to determine which option suits you best.

Asset Protection – Defensive planning is a must for physicians. Your ability to produce an income is most likely your greatest asset. You need to obtain the maximum disability coverage available, as early as possible and focus on the after-tax benefit

Other assets such as your medical practice, rental properties, office buildings, and recreational vehicles should be owned by their own Limited Liability Company or LLC. Doing so should limit any claims to that specific LLC, and not the rest of your assets.

Titling your home as “tenants by the entireties” will protect your home equity from creditors of just one spouse and obtaining a personal umbrella policy will further protect you from liability exposure.

Retirement – Most physicians get a late start saving for their retirement. You will want to maximize your retirement contributions as soon as possible.

Your company retirement plans should be the first place to look along with supplement accounts such as cash balance plans and taxable accounts. Retirement plans and IRAs can also serve as part of your asset protection plan as most are protected from creditors.

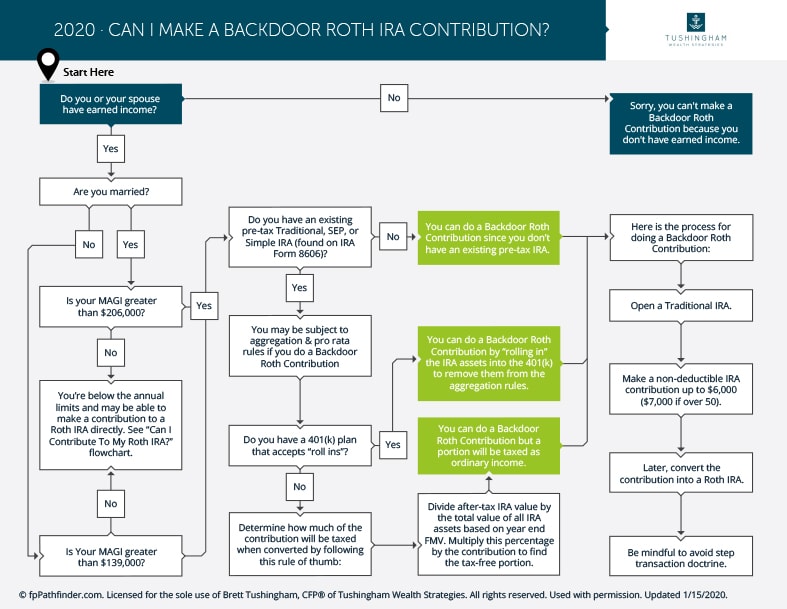

A back-door Roth IRA is another savings option that offers tax-free growth of assets.

Can I make a backdoor Roth IRA Contribution? Download Flowchart

College Planning – It’s no secret that the price of an education is skyrocketing with some schools now costing over $300,000.

Proactive college planning starts with funding 529 savings accounts as assets grow tax-free when used for qualifying expenses and are protected from creditors in most states, within limits.

Most physicians will not qualify for need-based financial aid based on their income. Your focus needs to shift towards merit aid when applying to schools. Merit aid is usually based on your child’s academic profile and not on your family’s income or assets.

Physicians require specific expertise and coordination in addressing their needs. The challenge is that most are too busy running their practices and have little time left over to do so. Hiring a “Personal CFO” might be the solution.