The current pandemic has created challenges for all of us, especially physicians. There are threats to their own health, loss of revenue as elective procedures are canceled and difficulties in caring for their patients.

Below are some resources to help address these concerns.

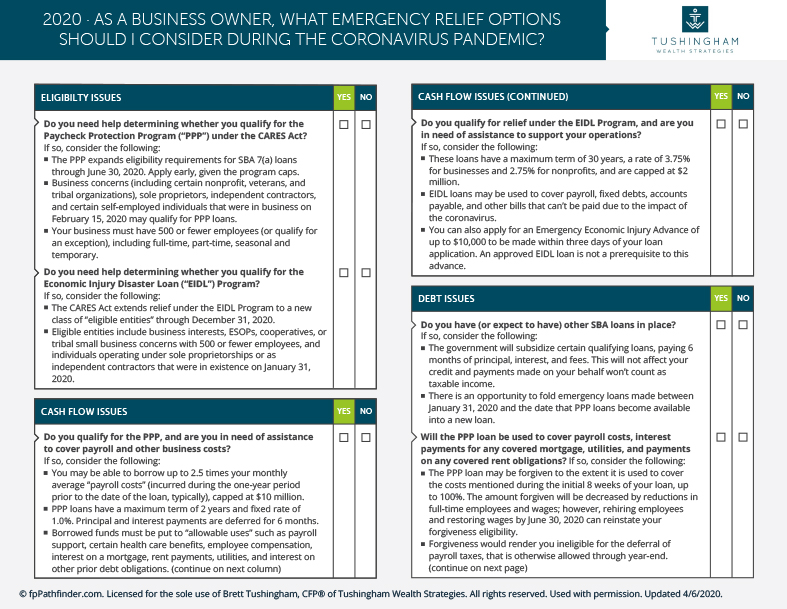

We reviewed provisions of the CARES Act in a previous blog but wanted to highlight specific ones here that most likely pertain to physicians.

Paycheck Protection Program (PPP)

The PPP program provides loans, through the Small Business Administration (SBA), to businesses and non-profits.

Who qualifies?

Businesses with under 500 employees and non-profits. You will need to certify that your business is experiencing an economic uncertainty as a result of the crisis, the loan is necessary to support ongoing operations and will be used for specific purposes such as payroll.

What are the loan terms?

The interest rate is up to 1%, with a six-month deferment of payments, and the term is two years.

What can loans be used for?

Payroll costs of up to $100,000 per employee, including paid sick and medical leave and health insurance premiums. This includes net-earnings from self- employment. Other eligible expenses include rents, mortgage interest and utilities.

How much can you borrow?

The lesser of $10 million or 2.5X the average monthly payroll cost of the prior year.

How much is forgiven?

The amount you spend on payroll, mortgage interest, rent and utilities in the eight weeks after the loan is originated. If you reduce employee compensation by more than 25% (compared to 2019) or reduce employee headcount the amount of loan forgiveness will be reduced.

We recommend that you apply with an SBA approved lender as soon as possible if you intend to apply.

Coordination with CARE Act

If you obtain a PPP loan you are not eligible for the employee retention credit. If you have debt forgiven as part of the PPP loan you are not eligible for the payroll tax deferral provision.

As a business owner, what emergency relief options

should I consider during the Coronavirus Pandemic?

Download Checklist Now

Student Loans

Federal student loan payments are suspended through September 30, 2020 whereby interest will not accrue. If you plan to stop payments, we recommend that you contact your loan provider.

Private loans are not included in the Act. Some lenders are already providing relief in some instances, so we recommend that you contact your lender if necessary.

Physicians in the Public Service Loan Forgiveness program should immediately contact their loan provider. The Act states that suspended payments count towards the 10 years of qualifying payments. If this is the case, and you plan to continue in the program, then you will want to ensure that payments are suspended.

Retirement loans and distributions

This is the last place that we recommend you access capital. That being said, recent changes have made these provisions more appealing.

The 10% early withdrawal penalty is waived on up to $100,000 of eligible distributions from retirement accounts. Taxes on those distributions can be paid over three years or you can roll any portion of the distribution back into your account over that same time period.

If you expect to be in a much lower tax bracket this year you might want to consider paying tax on the entire distribution now.

The maximum 401(k) or 403(b) loan has increased to $100,000 and payments can be delayed for up to one year.

Medicare Advanced Payment Program

The Centers for Medicare and Medicaid Systems has expanded the Accelerated and Advanced Payments Program. Providers can receive up to six months of reimbursements and processing time for payments have been reduced to as little as four days. The accelerated payments are essentially interest free loans against future Medicare claims.

Telemedicine

Now is a great time to develop a digital health offering for your practice. The Centers for Medicare and Medicaid Services have broadened the range of services patients can receive from their doctors.

Medicare will now pay for most telehealth services across the county, including in patient’s places of residence. Patients can now receive most services from the comfort of their home.

Below are a few resources to help you implement a telemedicine service in your practice.

These are challenging times for most physicians. Some proactive planning can help alleviate current cash flow concerns, keep staff employed and help you continue servicing your patients. Thank you for your service and let us know if you have any questions.

Get Your Complimentary Copy of

9 Money Mistakes Doctors Make: Download Now