DIAGNOSIS: Are you in good health and can pay for most medical expenses with cash?

TREATMENT: Consider fully funding an HSA account.

What is an HSA?

An HSA is an investment vehicle offered to individuals who are covered by a high deductible health plan, not claimed as a dependent, and not enrolled in Medicare.

A “high deductible” health plan must have a minimum deductible of $1,400 for self-only coverage or $2,800 for family coverage (in 2021) and can have a deductible as high as $7,000 for an individual or $14,000 for a family (in 2021).

The maximum contributions to an HSA for an individual are $3,600 and $7,200 for a family, plus a $1,000 “catch-up” contribution for those over age 55.

The Benefits of an HSA

- There is no time limit on when funds in an HSA must be used, unlike flexible spending accounts.

- If the HSA is not used before death, a surviving spouse can continue the HSA in their name.

- Triple tax benefit – Contributions are tax-deductible, growth is tax-deferred, and distributions are tax-free when used for qualified medical expenses.

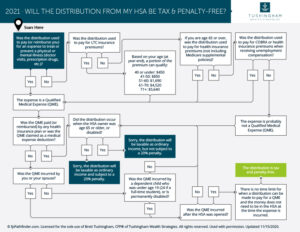

Will the Distribution from My HSA be Tax-Free? Download Flowchart

Should I Contribute?

Below are some reasons why you might consider contributing to an HSA account.

- Your cash flow and savings allow you to fund your HSA and pay the higher deductible if necessary.

- You don’t expect significant health care expenses.

- You have time for the account to grow and won’t need to access the funds until age 65.

The HSA should be viewed as a supplemental retirement savings account used to pay for medical expenses in retirement tax-free. And with retiree medical expenses likely to be over $250,000, there’s no better way to pay for them than through an HSA account.

Talk to a Certified Financial Planner to explore your options.