The value of receiving a guaranteed income stream with inflation protection for the rest of your life cannot be understated. Every dollar of Social Security received is one less dollar that needs to be pulled from your portfolio. So, when should you begin to claim your benefit? Let’s explore three scenarios.

Claim as Early as Possible

Outside of survivorship benefits or disability, the earliest you can claim benefits is age 62. Doing so will result in a sharp haircut and is usually not worth it. You might want to consider delaying retirement in order to claim later and garner a larger benefit. Below are some reasons to claim early.

- No other sources of income or assets…you need the money.

- Poor health or reason to believe you won’t live the average life expectancy

Claim at Full Retirement Age

Delaying until your full retirement age (FRA) can garner between 5 to 6.7% in additional benefit per year. You might consider waiting until your full FRA if:

- You plan on working after age 62

- Have limited investments or income streams outside of Social Security

- Single income household where delaying benefit would restrict the ability of your spouse to claim spousal benefit

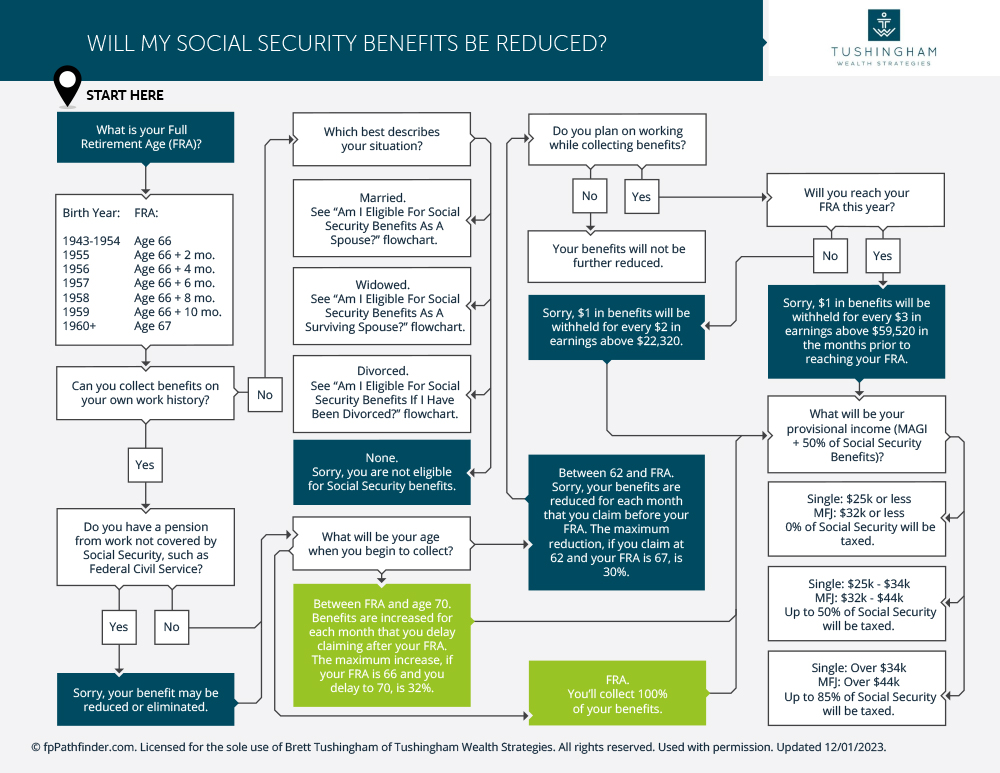

Will my social security benefits be reduced?

Download this flowchart to help find the answer.

Claim at Age 70

Every year you delay in claiming past your full retirement age will garner you an extra 8% plus any inflation adjustments. So why should you wait until age 70 to claim?

- Good health and longevity in family

- It usually pays for the higher earning spouse in duel income households to delay due to the higher survivor benefit

- Possess other sources of available income to meet cash flow needs, allowing couple to fill up lower tax brackets with Roth conversions, before required minimum distributions start.

- Risk averse and would prefer a higher guaranteed income stream as protection against potentially poor market returns, unexpected inflation or longevity risk.

There is no one size fits all when deciding on a strategy. Your income, assets, age and life events (i.e. disability, death or divorce) are a few of the factors that could impact your Social Security start date. Talk to a certified financial planner (CFP®) or use online software to at least establish a baseline strategy. The planning will be well worth it.