2019 is almost in the books. Below are five actions that physicians can take as part of a proactive, year-end review.

Refinance Mortgage and Student Loans – Mortgage rates have come down considerably this year and are near historic lows. Bankrate is a great place to start your search. If you can shave at least .25 basis points off your current rate with minimal closing costs it usually makes sense to refinance. The key is to not extend the term on your current mortgage and to continue making the same payment after the refinance.

Most physicians graduate with student loan debt, with the average balance being $200,000. Unless you plan on pursuing public service loan forgiveness, now could be a great time to refinance. Student loan rates are higher than mortgage rates and most physicians will not be able to deduct the interest. For these reasons we usually encourage our clients to aggressively pay them down.

Explore Online Money markets – The interest we receive on our checking and savings is sometimes an afterthought, but it shouldn’t be. Online banks offer substantially higher rates than their brick and mortar counterparts, are liquid and provide FDIC insurance on deposits. With some online banks currently paying as high as 2%, now is a great time to compare rates and potentially make thousands of more dollars, risk-free, on your cash.

Review the Qualified Business Income Deduction – Private practice physicians and physicians with side businesses should pay close attention to the qualified business income deduction (QBI). This deduction is 20% of qualified business income, or the net income of your business. The deduction begins to phase out when taxable income exceeds $321,400.

Physicians who qualify for the deduction need to realize that making tax deductible contributions to retirement accounts will reduce their deduction. This is because the contributions are excluded from QBI. Some physicians might be better off contributing to a Roth 401(k) or taxable accounts. For the ones who don’t qualify, because their income is too high, continued pre-tax contributions usually make sense.

Establish a Retirement Account for Your Side Gig – Many physicians earn supplemental income through consulting or speaking engagements. Establishing a SEP IRA is a great way to shelter some of that income. Another, lesser known retirement account, is the Solo 401(k). Unlike the SEP, a Solo 401(k) combines employee and employer contributions. The employee contribution limit for 2019 is $19,000 ($25,000 if over 50), and that limit applies across all your retirement plans. An added benefit of Solo 401(k) plans is that they are not included in the pro rata calculation for Backdoor Roth contributions. Solo 401(k) plans need to be established before year-end.

Shop Around Your Asset Protection – As part of any defensive planning strategy most physicians should have life insurance, disability insurance, property and casualty and malpractice coverage. Annual assessments should be done to determine if your coverage needs have changed as well. If you have children who will be driving soon then look into adding an umbrella policy. Has your income increased substantially? Then review your disability policy to avoid any shortfalls in coverage. A quick review and shopping around of your coverage is sound planning.

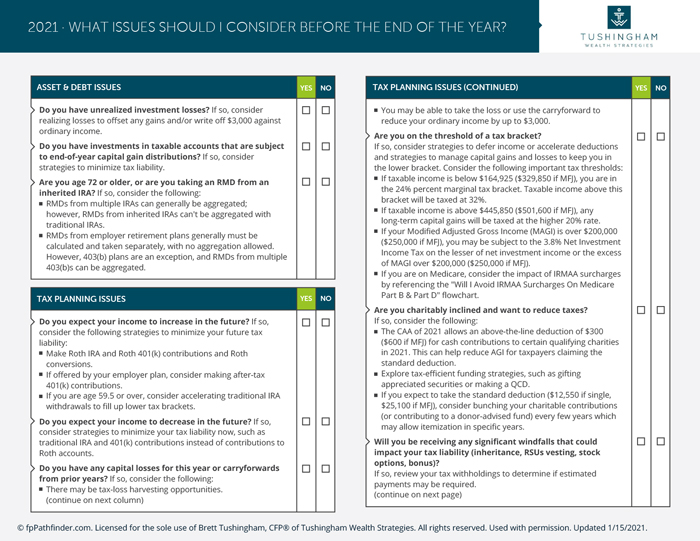

What issues should I consider before the end of the year?

Download this checklist to help find the answer.