FINANCIAL PLANNING

FINANCIAL PLANNING

WHAT IS PERSONALCFO SERVICE

Create a personalized plan for your future.

Our “Personal CFO” service will help you proactively plan and coordinate your financial future. We will start by asking questions and listening. This helps us gain a thorough understanding of where you are now, where you want to go and develop a personalized plan to get you there. We want to help you make smart financial decisions, so you can lead your ideal life, worry-free.

Your comprehensive plan may include many of the following disciplines.

Retirement Planning

We will help you organize all your financial information, establish goals and plan for the future. We will continually monitor your progress and make any necessary adjustments to optimize your plan’s success. When you transition to retirement we will help choose the appropriate Medicare coverage, Social Security claiming strategy and coordinate the liquidation of your accounts in the most tax-efficient manner.

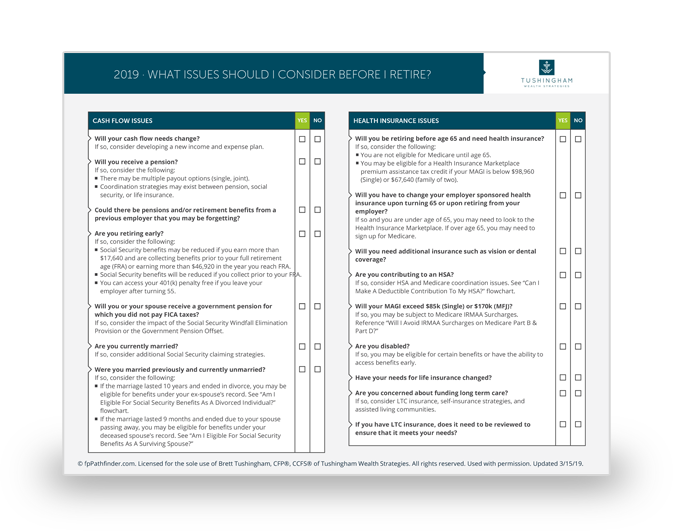

Retirement Planning Checklist

Estate Planning

Your estate plan will direct how your assets are distributed and identify important roles such as trustees, guardians and powers of attorney. Without a plan in place you could lose control of these decisions and pay more tax than is necessary. We will help you establish a sound estate plan and coordinate the implementation with an attorney.

Download:

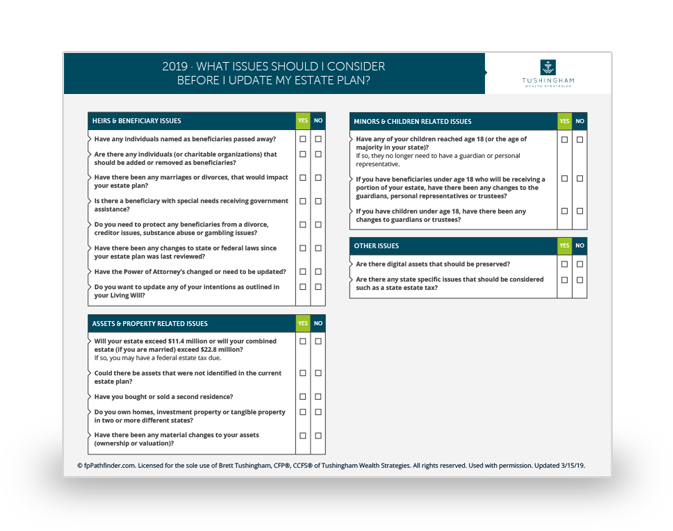

Estate Planning Checklist

College Planning

It is not enough to just “save” for college. We will also show you to “pay” for college by assessing the areas of college selection, financial aid, tax aid and wealth management. Our goal is to help you pay the cost as wisely as possible and protect your retirement assets.

Free Resource:

Learn more about our College Planning services.

Free Guide:

2021 Guide to College Financial Aid

Risk Management

Sound planning requires that you identify potential risks to your plan that could impede your future success. This might entail transferring that risk to an insurance company, to minimize the potential of a catastrophic event. We will guide you in the areas of life insurance, disability, long-term care and property and casualty coverage.

Social Security Optimization

A substantial portion of your retirement income needs can be met with Social Security. We will review all of your options, help determine your optimal claiming strategy and integrate that with the rest of your retirement plan.

Tax Planning

Minimizing taxes is key to increasing your wealth. We will coordinate with your CPA to review your current tax return and proffer recommendations when necessary. We will manage your assets with tax efficiency in mind and help optimize your retirement distributions by coordinating the liquidation of your accounts.

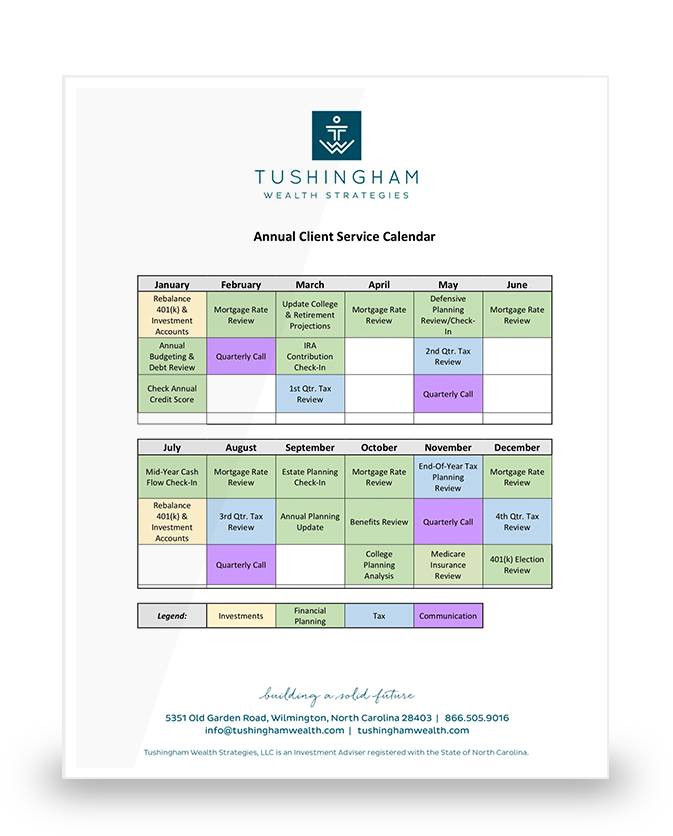

Annual Client Services Calendar

Our Financial Planning services are proactive and ongoing throughout the year with regular checkpoints, plan updates and periodic communications. Click here to see a sample calendar of annual activities.

Download:

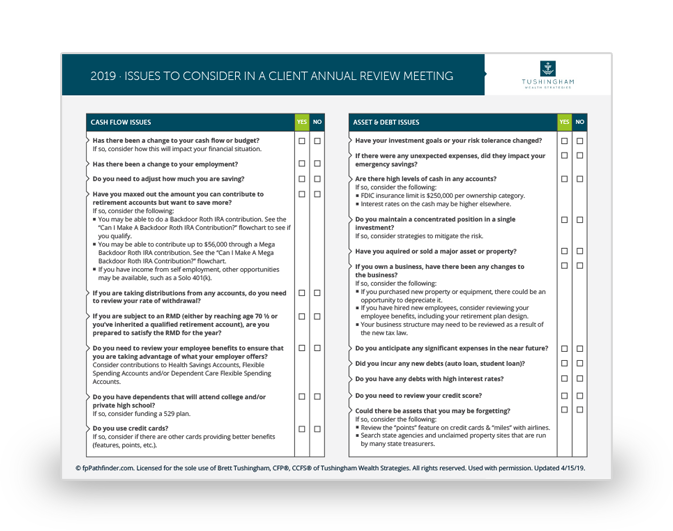

Annual Meeting Checklist

How are we compensated?

Our ongoing Financial Planning service is included with our Wealth Management services.

We also provide Financial Planning on a fixed fee basis if we are not managing your assets. Fixed fees will be determined on a case-by-case basis with the fee based on the complexity of the situation and the needs of the client. The fixed fee will be agreed upon before the start of any work and is a minimum of $5,000.

If you are looking to develop a strategy to pay for college, an income sustainability plan or for a single go-to fiduciary advisor to oversee every moving part of your financial life then please contact us for a free consultation.

Your life in a box.

Customized Wealth Portal

Your Personal Wealth Portal will serve as an easy way to track and manage your accounts and important documents in one convenient and secure location.

- Account balances and positions will be updated daily

- Access to an unlimited amount of online storage for photos, documents and videos

- Budgeting tool to stay on top of your cash flow

- Reports to see your entire financial picture

- Online collaboration in real-time to review your plan

This is all included with our Wealth Management services.

Schedule an Appointment

Please select a time from our calendar below to speak with an advisor.