BLOG

The FAFSA – Why Every Family With College Bound Children Should File It

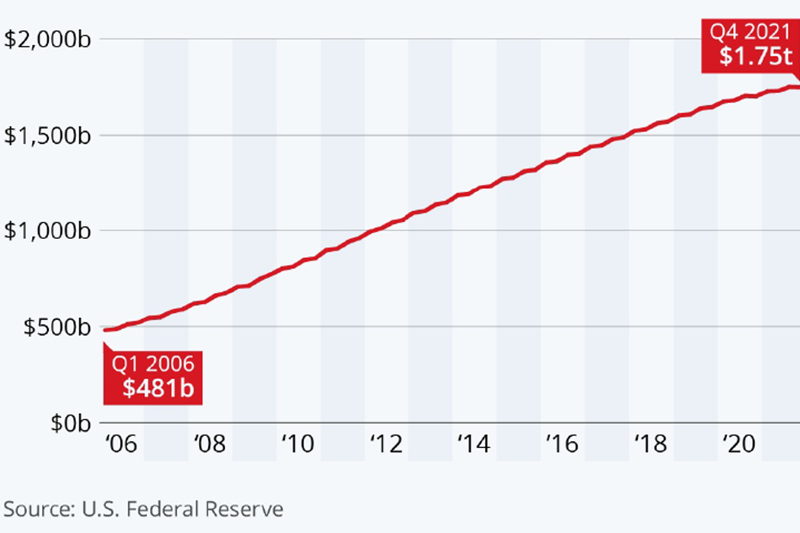

Outstanding student loan debt is approaching 1.8 trillion, second only to mortgage debt for consumers. Student loan default rates are almost 11% and the average student loan debt per borrower is $39,351. These are some eye-popping numbers that should prompt...

Financial Planning for College Bound Families – 3 Questions You Need to Answer

Some colleges now cost over $80,000 a year. But don’t worry, the government will provide you with student loans to fund most of it with minimal regard to your credit score or future earning potential. What can go wrong? The average...

Should I Take the Lump Sum or Pension?

My brother has worked for the same company for over twenty years. Now that is something you don’t see much of anymore. The average person now switches jobs every four years. He plans on calling it quits soon and...

How to Optimize your Benefits Enrollment

Optimizing your employee benefits is pivotal to your retirement planning. With so many options nowadays, it can be confusing to determine what benefits to select. This can get even more complicated when both spouses have access to benefits. So, what can you do to...

How Will My Capital Gains Be Taxed?

We get this question a lot, especially around year-end. As most people already know, capital gains are taxed at lower rates than ordinary income. But at what rates are they taxed at and what is the primary driver in determining those...

Should I Fund a Health Savings Account (HSA)?

DIAGNOSIS: Are you in good health and can pay for most medical expenses with cash?TREATMENT: Consider fully funding an HSA account. What is an HSA? An HSA is an investment vehicle offered to individuals who are covered by a high deductible health plan, not claimed...

Should I Consider a Roth Conversion?

DIAGNOSIS: Do you have lower income than usual or wealthy heirs?TREATMENT: Consider a Roth Conversion. Would you ever want to pay taxes before you had to? It sounds counterintuitive but the answer is sometimes yes. A Roth Conversion is when...

How Physicians Can Pay for College and Protect Their Retirement

The biggest impediment to an on-time and comfortable retirement is overpaying for your children’s education. Most financial advisors just say, “save in a 529 account”. This isn’t enough and fails to address the best way to pay for a potential $300,000...

How to Transition Jobs and Protect Your Retirement

2020 has been anything but ordinary. Many people have lost jobs or had to transition to a new one due to reasons beyond their control. This can be an emotional time, yet one that can also open the door for other opportunities. First things first. You need to...

Physicians Financial Planning Checklist

Physicians face many unique challenges when it comes to financial planning. Most graduate school with student loans, they have substantial liability exposure and begin saving for their retirement at a late age. Proactive planning can help you...

What if We Don’t Qualify for Need-Based Financial Aid?

Many higher income families assume that they will not qualify for any financial aid. They would usually be correct if the aid were need-based. However, financial aid can come in many forms. Merit Based Aid There are two types of financial aid, need-based and...

Schedule an Appointment

Please select a time from our calendar below to speak with an advisor.