DIAGNOSIS: Do you have lower income than usual or wealthy heirs?

TREATMENT: Consider a Roth Conversion.

Would you ever want to pay taxes before you had to?

It sounds counterintuitive but the answer is sometimes yes.

A Roth Conversion is when you move traditional IRA assets to a Roth IRA and pay taxes on the converted amount. There are several benefits to a Roth IRA.

- Money grows and is distributed tax-free

- No required minimum distributions

- Increased tax planning flexibility in retirement

So, when would it make sense to convert and pay the taxes now vs. later?

Low-income year

If your income is expected to be lower than usual and put you in a lower tax bracket, you should consider a conversion.

A loss of a job, down year, or career transition are events that should prompt a review. If you experience a reduction in income but expect your income to rebound in future years, a Roth conversion might be the way to go.

Retirement Gap Year

We call the years after retirement and before receiving Social Security and required distributions from your retirement accounts to be “gap years”.

If you can meet your spending needs through other means then you should consider filling up the lower tax brackets in these gap years. For most physicians, once they begin Social Security and taking IRA distributions they are pushed into a higher tax bracket.

Estate Planning

Are your heirs in a higher tax bracket? Distributions from Inherited Roth IRAs are tax-free. This could make the Roth IRA a perfect asset to transfer to that wealthy heir.

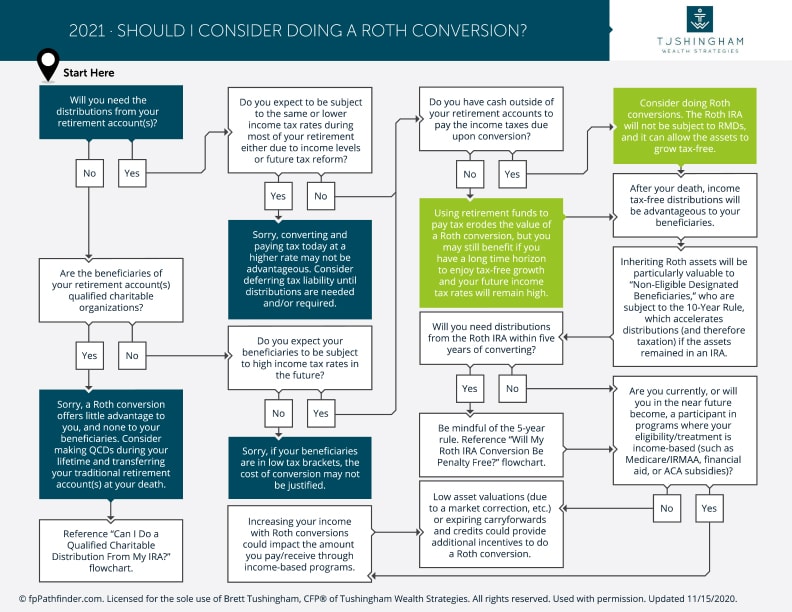

Should I do a Roth Conversion? Download Flowchart

Before proceeding with a Roth conversion please be careful!

Accelerating income could subject you to higher Medicare premiums, reduce financial aid eligibility, loss of health care premium tax credits, and minimize certain deductions and credits. And since you cannot undo a Roth conversion, proper planning is a must. Talk to a Certified Financial Planner to explore your options.