Many higher income families assume that they will not qualify for any financial aid. They would usually be correct if the aid were need-based. However, financial aid can come in many forms.

Merit Based Aid

There are two types of financial aid, need-based and merit aid. Need-based financial aid is based on the assets and income of the family. Merit based aid is generally based on the academic record of your child. You could make over a million dollars and still receive merit aid awards.

Applying to schools where you child ranks in the top 20% academically will dramatically increase the likelihood of receiving merit based financial aid. You need to apply to the right schools though as many of the top tier schools offer little in the way of merit aid. This is why your school selection is so important.

School Selection

The school list is the foundation of your college planning strategy, especially if your focus is on merit-based aid. Most families with high achieving children immediately target top-flight schools such as Harvard or Yale but are surprised to discover that such schools provide little in the way of merit-based awards. Reason being, they don’t have to.

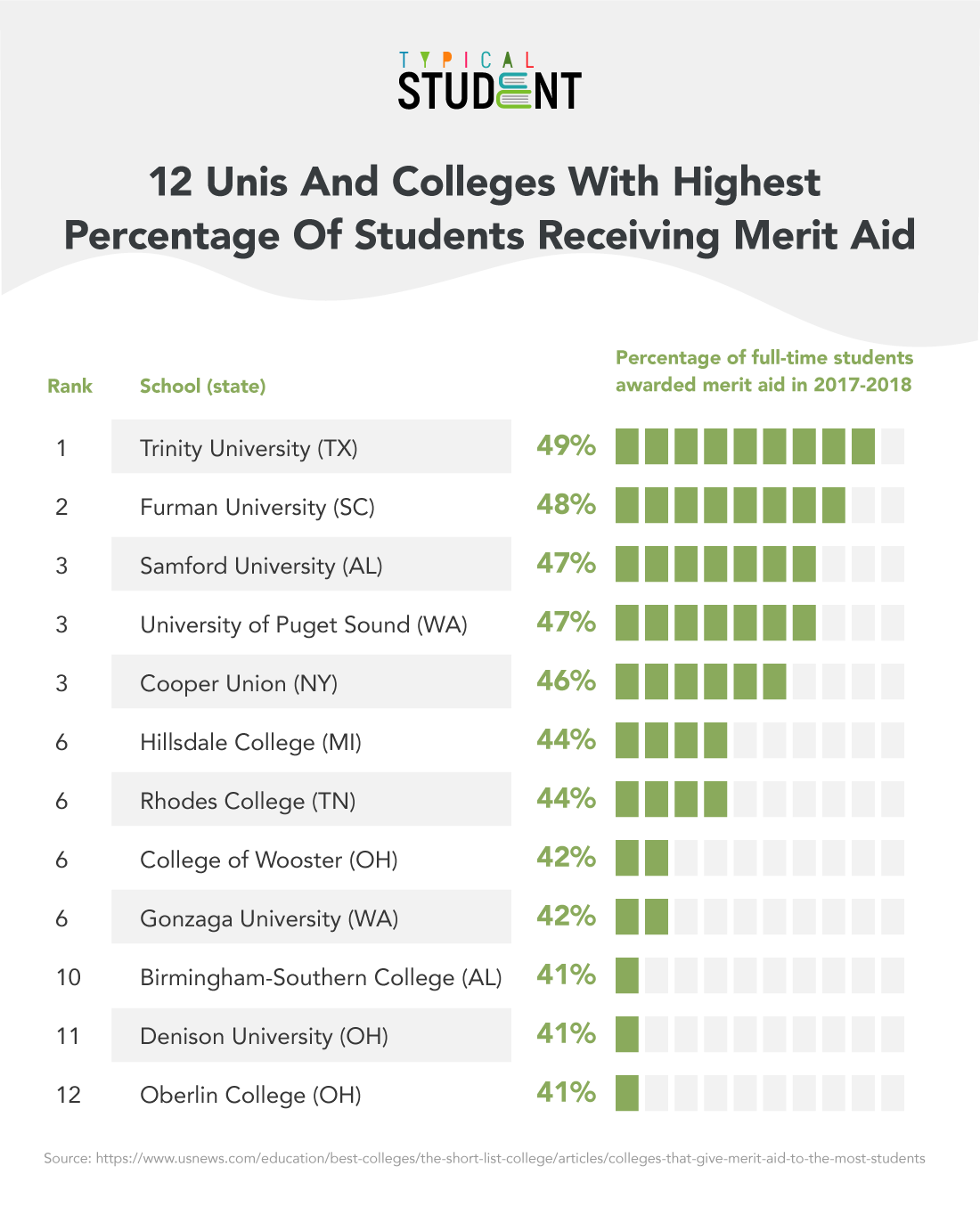

There are plenty of selective schools with slightly less name recognition willing to offer merit-based aid to the right students. The key is to play matchmaker, find schools where your child fits in, ranks high academically and are willing to offer aid.

Examples of such schools are George Washington, Babson College and Cooper Union. For example, 46% of the students at Cooper Union receive merit-based aid with the average award being $23,000.

Tax Aid

Not all aid comes directly from the school. When we develop a late-stage college planning strategy as part of our Personal CFO service for clients we always explore tax aid. One form of tax aid is to hire your child to work for your business. Your child can earn up to $12,400 in 2020 without owing any Federal tax. If you are in the 35% tax bracket this is the equivalent of a $4,340 tax scholarship. When you add additional children over the course of many years the tax savings can be substantial. Your child will also be obtaining valuable business experience, reducing the need for student loans and even be able to fund a Roth IRA. The work must be legitimate and documented and your child must receive a reasonable wage.

College is an enormous investment. The less you pay the better the return for your child and the more assets you can earmark for your own retirement. You need to do your research or find someone who can assist in exploring what schools’ options suit your child best.